Bloggfærslur mánaðarins, nóvember 2019

Hugleiðsla, heiður skólanum sem fór í hugleiðsluna, að tengja sig við baklandið, alheiminn, Guð.

Jesú sagði, leitið sannleikans, sannleikurinn mun gera ykkur frjáls, já úr fjósinu segjum við.

Af hverju heldur þú, að ég víxlarinn hafi tekið Jesú og Nikola Tesla að mestu út úr skólunum?

Það er vegna þess, að ég vil ekki að þið skiljið hvernig ég hef ykkur fyrir þræla.

Þú átt að gera verkin þín, en jafnframt átt þú að segja í huganum, Guð, eða Jesú, vilt þú hjálpa mér að skilja málefnin. Þá hefur þú hugann opinn fyrir þekkinguna frá kjarnanum, sem Nikola Tesla talar um.

Við höfum vanist á að nota orðin Guð, Heilagur Andi, Heilög Guðs Móðir um þessa miðju, sem við skiljum ekki.

En mundu að með þessu opnar þú flæði til fjölskyldunnar þinnar, sveitarfélagsins þíns og landsins þíns, og allra stjórnvalda.

Og mundu, að Jesú og Nikola Tesla voru og eru vísindamenn, og voru að kenna okkur sannleika, til að gera okkur lífið bærilegt, og frelsa okkur frá púkunum, púkunum í okkur.

Við skulum varast að halda að við séum betri en aðrir, en reynum að leita að því sem virðist leiða okkur í góðar áttir.

Við eigum að fylla Kirkjurnar, munum að þegar við biðjum saman, þá margfaldast flæðið frá Miðjunni, og upplýsingin streymir í allar áttir og umvefur allt umhverfið, jörðina, alheiminn.

Mundu, að heimurinn er ANDLEGUR, segir Nikola Tesla.

Auðvitað eigum bæði ég og þú, við allir heima í kirkjunum, í bænastundinni, hugleiðslunni, þótt við göngum fyrir eðlinu, gyrndini og séum syndum hlaðnir.

31 Og Jesús svaraði þeim: „Ekki þurfa heilbrigðir læknis við heldur þeir sem sjúkir eru. 32 Ég er ekki kominn til að kalla réttláta til afturhvarfs heldur syndara.“

Konan hefur hlutverk, og er víruð til að þjóna því, Karlinn hefur hlutverk og er víraður til að þjóna því. Þegar karlinn er fastur í konunni, tekur hún til sín andlegu orkuna, spiritual power, og nýtir hana. Þá virðist karlinn ekki hafa fullan aðgang að vitinu, minni yfirsýn. Við flestir skiljum þetta ekki enn þá, en virðumst geta lært það.

Við það að halda sig frá konum, gyrndum um tíma, virðist opna samband við kjarnann hans Tesla, miðjuna, Guð, Heilagan Anda,

Þegar þú ert með með munninn fullan af sykri, þá finnur þú síður annað bragð. Konan tekur athyglina og þá dofnar sambandið við kjarnan, og þá andlega heiminn. Konan virðist þurfa andlegu orkuna til að skapa nýjan einstakling.

Hér er velt upp hugmyndum, til að reyna að skilja. Ef þú leitar að skilningi, hefur opin huga, þá eru meiri líkur á að innsæið skynji lausnina.

slóð

31.8.2018 | 09:28

Tesla: Þekkingin á hvernig andinn og lífsorkan breytast yfir í óskirnar, og ná stjórn á tilfinningunum.

Hindúar kalla þetta Kundalini Yoga.

Þessa visku er hægt að læra, en það tekur mörg ár, eða er meðfætt.

Mest af þessu er meðfætt hjá mér.

Þetta tengist mest kynhvötinni, kynorkunni, sem hefur hvað mesta útbreiðslu í veröldinni.

Konan dregur þessa orku til sín, og þá andlega kraftinn.

Egilsstaðir, 25.11.2019 Jónas Gunnlaugsson

Tesla: Þekkingin á hvernig andinn og lífsorkan breytast yfir í óskirnar, og ná stjórn á tilfinningunum.

Bloggar | Breytt s.d. kl. 14:16 | Slóð | Facebook | Athugasemdir (0)

Nú virðist leikfléttan vera að ná af okkur KVÓTANUM.

Munum eftir fréttum um að hin og þessi stjórnvöld í útlandinu, ætli að sjá til þess, að íslensk stjórnvöld hristi vel upp í sjávarútveginum á Íslandi. Við vorum heppin í Isave, þá voru lögin með okkur.

Fyrst var það að reyna að ná af okkur best skipulögðu orkufyrirtækjum fólksins, Hitaveitunum og Raforkufyrirtækjum, Landsvirkjun og Rafmagnsveitunum Ríkis og Sveitarfélagana.

Þessi fyrirtæki fólksins, sköpuðu okkur ódýra orku og mjög öflugt dreifikerfi.

Víxlararnir vildu fá að sprengja upp orkuverðið, eins og til dæmis með Frjálsa uppboðs (svindl?) markaðnum í Kaliforníu.

Slóð

Jónas Gunnlaugsson | 17. apríl 2019

000

Til að ná kvótanum, var búið til stórmál út af svokölluðum mútum, en þær eru notaðar um allan heim, og eru að því er virðist mest notaða kerfið.

Í nútíma bankaheiminum, eru notuð allskonar svindl? víxlanir, er það skylt mútunum?, prósentur, umboð, fólk á launum til að vinna málefnum framgang?

Tökum til dæmis þegar kreppan 2008 var búin til, á heimsvísu, svo að hægt væri að ná öllu, eða sem flestu af fólkinu.

Slóð

Þegar þú selur einkaaðila peninga sköpunina, bókhalds færslurnar, og hann kemst upp með að segjast eiga, hafa lánað okkur verðmætið, þá erum við kjánar í fjósinu hjá víxlaranum sem eignast allt sem við gerum.

Auðvitað á að skoða málið og skila öllu aftur, en víxlararnir það er við, getum engu skilað, en við öll verðum að laga kerfið jafn óðum og við spillum því. Hafa kerfið stöðugt í lagi.

En kvótinn aftur.

Ef íslenska útgerðin átti ekki að nota mútukerfið, þá voru þeir að stórum hluta útilokaðir frá heimsviðskiptunum.

Ef við getum sprengt upp Fiskveiðikerfið íslenska, með því að segja að þeir hafi notað þetta mútukerfi sem var að einhverju leiti gert ólöglegt, þótt það sé mikið notað í heimsversluninni, og látið bjóða kvótann upp og hann seldur hæstbjóðanda.

Þá getur sá hæstbjóðandi auglýst eftir einhverjum til að veiða kvótann, og þá er líklegt að þrælaskipin geti boðið hæst.

Best er að íslensku skipin fái ekkert að veiða og útgerðin missi þá skipin. Þá get ég víxlarinn keypt skipin á hagstæðu verði.

Ef hirðmönnum Evrópusambandsins tekst að setja okkur undir Evrópureglurnar, þá er kvótinn farinn.

Baráttan um stjórnarskrána er öll um að koma inn klausu um að færa megi völdin út úr landinu. Þá eru einhverjir látnir setja inn 100 reglur, til að fela þessa einu, sem gerir allar hinar marklausar.

Þá er stjórnarskráin til einskis, reglurnar koma allar frá Evrópu.

Munum hvernig ISAVE, og svo tilbúna Kreppan 2008, Orkupakkarnir, og nú að ná KVÓTANUM er allt af sömu rótum.

Slóð

17.11.2019 | 11:12

Slóð

16.11.2019 | 01:35

Slóð

15.11.2019 | 00:26

Egilsstaðir, 25.11.2019 Jónas Gunnlaugsson

Bloggar | Breytt s.d. kl. 21:22 | Slóð | Facebook | Athugasemdir (0)

Er þetta virkilega rétt, að ef einhver skrifar sannleika, þá sé búin til leikflétta?

Þegar ætlunin er að sviðsetja óhappaverk á einhvern mann, þá eru sendir fulltrúar út til að dreyfa svona lygum.

Er það rétt, að hann sé orðin svo ofbeldisfullur maður?

Við vonum að þetta sé aldrei gert.

When the intention is to stage a crime on someone, representatives are sent out to spread such lies.

Is it true that he has become such a violent man?

We hope this is never done.

Egilsstaðir, 24.11.2019 Jónas Gunnlaugsson

Bloggar | Breytt s.d. kl. 23:17 | Slóð | Facebook | Athugasemdir (0)

Skattstofan sautjánhundruð og súrkál.

Heyrðu, er það skattstofan, halló, halló, er það Jón, sæll og blessaður. Heyrðu, ég er að fara til Íu með skreiðarfarm. Þú manst, við verðum að senda tvo gáma fulla af brennivíni, annars keyra þeir allt út í skóg og pöddurnar éta alla skreiðina. Já, það er gott veður, já, já, já, en hvernig bóka ég þetta? Já, já, bóka það á kostnað við skreiðina? Já, já, já, þetta er góð lausn, þakka þér mikið fyrir. Það er erfitt að gera það sem ekki má, en við verðum að bjarga því til að þjóðirnar geti brauðfætt sig.

Já, þingmennirnir, eru eins og við vorum á miðjum aldri, blautir á bakvið bæði eyrun og skildum ekkert. Þeir tala, tala, tala, þetta eru unglingar. Þeir skilja betur þegar þeir verða komnir á okkar aldur, já ert þú ekki orðin sjötugur? Já, við erum reknir út þegar við erum farnir að skilja hlutina. Guð veri með þér góurinn.

Heyrðu mig Jón aftur, ég gleymdi frosna fiskinum til USA. Æ, þú manst, þeir heimta greiðslu fyrir vernd, annars láta þeir einhvern taka kælinguna úr sambandi og frostnu flökin verða ónýt. Já, já auðvitað björgum við þessu, einhverjir verða að halda öllu gangandi, við verndum fólkið, við lesum um vísindamennina Jesú og Nikola Tesla.

Kemur þú ekki á fundinn á mánudaginn? Já, þá verður rætt um geislaskjáinn hans Nikola Tesla sem við lifum í, já og sennilega er elektronan myndpunkturinn í þrívíða skjánum. Já og manstu hvað við vorum stoltir þegar við lærðum um að Einstein væri búin að uppgötva að rúmmið væri tóm, og kennarinn sagði að fólkið hefði vitað lítið hér áður fyrr, það hefði haldið að rúmmið hefði verið fullt af eter. Já, og svo hló allur bekkurinn að því hvað allir hefðu verið heimskir.

Okkur var ekki sagt að Nikola Tesla hefði sagt að þetta tóm væri eintóm vitleysa, en okkur var sagt að Nikola Tesla væri skrítinn, vægt sagt. Já og manstu 1980 þegar nústaðreynda vísindin áttuðu sig á því að rúmið væri fullt af, einhverju, þá notuðu þeir orðið súpu. Jæja Jón minn, mikið var nú gaman að heyra í þér. Já, já, vertu margblessaður.

Egilsstaðir, 17.11.2019 Jónas Gunnlaugsson

Bloggar | Breytt s.d. kl. 11:34 | Slóð | Facebook | Athugasemdir (2)

slóð

000

slóð

https://www.traceinternational.org/trace-matrix

Ef ég má ekki auglýsa þetta svona þá breyti ég því strax.

Mútur

Í ljósbláu löndunum er lítið um það sem kallað er mútur.

Í þeim löndum er trúlega frekar talað um prósentur, umboðslaun eða þrýstihópur á launum og fleiri aðferðir.

Hin löndin hafa kerfi sem kallað er mútur.

Ef eitthvert fyrirtæki ætlar að eiga viðskipti í þeimm löndum, í þeim menningarheimi, þá verður fyrirtækið að laga sig að viðskiptaháttum og siðum þeirra þjóða.

Annars fá aðrir viðskiptin, þetta er mjög einfalt.

Sjá mynd hér aðeins neðar.

Slóð

15.11.2019 | 00:26

000

Skáldsaga?

Við höfum séð hvernig klístrun, klaustrun, er notuð til að láta karla og konur hlíða.

Við höfum séð hvernig hirðmenn konungs eru látnir koma orkulindunum til víxlaranna.

Við höfum séð hvernig hirðmenn konungs koma Þingvöllum undir, hvað skildi hún heita, UNESKO?

Við höfum séð hvernig Ísland er selt og stjórnsýslan sefur.

Við sjáum að stórfyrirtækin í heiminum eru í óðaönn við að kaupa allt vatn í löndunum.

Löndin í kring um flugvallarstæðið við Grímsstaði eru smásaman að komast í eigu víxlaranna.

Landið í kringum flotahöfnina við Finnafjörð er smásaman að komast í eigu stórfyritækjana.

slóð

Hirðmenn konungs fá svo störf við hirðina, hjá Sameinuðuþjóðunum eða Brussel.

Þar eru greidd góð laun skattlaus, og fjármögnuð með kolefnisskattinum?

Fólkið er gert hrætt, og þá vill það borga fyrir að bjarga heiminum.

Kolefnið er undirstaða alls lífs á jörðinni og þeim mun meira lífefni

þá verður gróðurinn meiri, og þá meiri matur og súrefni, fyrir men og dýr.

000

klikka ámynd, þá stærri

klikka á mynd, þá stærri

2019 Results Select a Different Year 2016 2014 2017 2018 -._.-*^*-._.-*^*-._.-

Showing 1 to 200 of 200 entries 000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bloggar | Breytt 21.11.2019 kl. 23:12 | Slóð | Facebook | Athugasemdir (0)

Ég hef ekki þekkingu á mútumálunum, og fletti því upp á smá upplýsingum, sem urðu 11 Ísland og 72 Namibia.

Í sumum geirum virðist þurfa að taka þátt í mútunum, til að hafa möguleika.

Ég er ekki að afsaka mútur.

Af hverju rannsakaði Alþingi ekki slóð Kreppufléttan, endurtekið , þegar eigurnar voru hirtar af fólkinu 2008?

Eigum við ekki að hætta í spillingunni?

000

TRACE

https://www.traceinternational.org/trace-matrix

Hvort ég má setja þetta smá sýnishorn veit ég ekki, og tek það strax niðut ef ég má þetta ekki.

Search:

Rank | Country | Risk Score | Domain 1: Interactions | Domain 2 : Anti-bribery Deterrence and Enforcement | Domain 3 : Governmental | Domain 4: Capacity for Civil Society Oversight |

11 | slóð Iceland | 17 | 22 | 10 | 13 | 17 |

| slóð Namibia |

|

|

|

|

|

72 |

| 47 | 59 | 34 | 44 | 35 |

Egilsstaðir, 14.11.2019 Jónas Gunnlaugsson

Bloggar | Breytt s.d. kl. 00:29 | Slóð | Facebook | Athugasemdir (2)

If this privatisation of the money supply was reversed, then that £50 billion would be available to fund our public services without there being a need to increase taxes. Indeed, the nation could enjoy increased spending on public services — wiping out NHS deficits, giving students free tuition and maintenance grants, increasing pensions — and a cut in taxes!

000

Íslenska neðst.

Aftur, Prosperity - uk

http://jonasg-egi.blog.is/blog/jonasg-egi/entry/1528300/

Egilsstaðir, 24.12.2014 Jónas Gunnlaugsson

"An Unlimited Amount of Money

Since the banks got into the housing market in the 1980s, with many building societies demutualising and becoming banks, they have become the major source of mortgages.

As banks are not limited to lending out only the amount deposited with them, but can create as much money as they wish in the form of loans to house-buyers, we now have a situation of an unlimited amount of money chasing a finite housing stock, which is the recipe for inflation. Even with twice as many houses available in the nation’s housing stock, house prices would still soar to the level that would enable the banks to squeeze the maximum amount of profit out of their borrowers.

This problem is particularly acute in London because this is where live the nation’s highly paid financiers, who easily earn the money to buy a nice place — and maybe a few more to rent out to the low paid!

The Privatisation of Money

In the years since 1946, when the Bank of England was nationalised, the amount of the money supply created by a public agency has fallen from 46% to 3%.

***

Currently the public purse benefits annually by about £1.5 billion on the profit of providing that 3% of the money supply.

***

By contrast, the banks, in creating the remaining 97% are subsidised by the British people to the tune of £50 billion every year.

***

If this privatisation of the money supply was reversed, then that £50 billion would be available to fund our public services without there being a need to increase taxes. Indeed, the nation could enjoy increased spending on public services — wiping out NHS deficits, giving students free tuition and maintenance grants, increasing pensions — and a cut in taxes!

The Money Fuse to the Climate Bomb

Debt, whether it is carried by an NHS Trust, a business or a family, is the greatest pressure under which anyone can labour. Yet whereas an NHS Trust, a business or a family can try to bring its accounts in order by earning more and spending less, a national economy and, far less, the global economy cannot.

Within such an economy one person’s spending is another person’s earnings. The global economy cannot spend less without earning less, and earning less will mean financial ruin for some people. It will mean families losing their homes, businesses going bankrupt and public services laying-off staff.

It is the frantic need for continued economic growth, both in this country and around the world, that is the cause of one of the world’s greatest threats: climate change.

The Solution

We can save the planet without causing a world-wide recession through the simple medium of removing the power of the private banks to create money. All money should then be created by a publicly-owned agency, which should be spent into circulation on public services.

Potentially, we could enjoy the benefit of both increased spending on public services and tax cuts together.

Removing the power of the banks to create money would mean that their lending would be limited to the amount of savings that they held, just as is the case with mutual building societies and credit unions.

This would limit the amount of money in the housing market and so end house price inflation.

But perhaps most importantly, we could end the current ‘dog-chasing-tail’ scenario of today’s frenetic and ultimately futile attempt of whole economies trying to escape from debt — when debt is the basis of their money supply.

It is this vain attempt to escape debt that is the cause of so much of humanity’s destructive impact upon the world’s climate and environment.

Boggling the Mind

The true nature of the money supply is so different to the popular perception, that trying to understand it and all the ramifications that stem from it is not easy.

***

Take your time, but not too much time, the longer the situation persists, the worse it will become and it will be the younger generation who will have to shoulder the burden.

***

The present entirely fraudulent money system is in place due to widespread ignorance.

***

Learn about the situation.

***

There are books on the subject, but the easiest way is through the web.

***

Armed with this knowledge, talk to your friends about this subject. Ask them where they think money comes from and how it is created. You will be surprised just how little most people know.

Only by ending this widespread ignorance can we end the great banking fraud and all the problems that stem from it".

000

Þýtt úr ensku:

Ótakmarkað peningamagn

Síðan bankarnir komust inn á húsnæðismarkaðinn á níunda áratugnum þar sem mörg byggingafélög breyttu starfsemi sinni og urðu að bönkum þá hafa þeir orðið aðaluppspretta veðlána.

Þar sem bankar eru ekki takmarkaðir af að lána út aðeins þær upphæðir sem lagðar er inn á þá, heldur geta þeir búið til eins mikla peninga og þeir vilja í formi lána til húskaupenda, þá erum við núna í þeirri stöðu að ótakmarkað peningamagn eltist við takmarkaðan húsafjölda sem er uppskrift að verðbólgu. Jafnvel þótt tvöfalt fleiri hús væru til staðar í landinu þá myndi fasteignaverð samt rjúka upp í þær hæðir sem myndi gera bönkunum kleift að kreista hámarksgróða úr út kaupendum sínum. Vandamálið er sérlega brýnt í London vegna þess að þar búa hæstlaunuðustu fjármálamenn landsins sem þéna auðveldlega peninga til að kaupa fallegt hús og e.t.v. nokkur fleiri til að leigja út til hinna láglaunuðu!

Einkavæðing peninganna

Á árunum síðan 1946, þegar Bank of England var þjóðnýttur, þá hefur magn peningaforðans sem umboð í eigu almennings skapa fallið úr 46% niður í 3%.

Núna græðir almenningur árlega um 1,5 billjón punda á hagnaðnum af að útvega þessi 3% af peningaforðanum.

Til samanburðar er bankarnir niðurgreiddir fyrir 50 billjón punda árlega fyrir að búa til hin 97%.

Ef þessari einkavæðingu væri snúið við þá væri hægt að nota þessi 50 billjón pund til að fjármagna þjónustu við almenning án þess að þörf væri á skattahækkunum. Þjóðin gæti meira að segja notið aukinna hagsbóta: þurrkað út tekjuhalla sjúkrasamlaganna, gefið námsmönnum upp skólagjöld og námslán, aukið við eftirlaun og lækkað skatta!

Peningakveikiþráðurinn í loftslagssprengjunni

Skuld, hvort sem sjúkrasamlög, fyrirtæki eða fjölskyldur bera hana, er mesti þrýstingur sem hægt er að vinna undir. Þegar sjúkrasamlag, fyrirtæki eða fjölskylda geta reynt að koma fjármálunum í lag með því að vinna sér inn meira og eyða minna þá getur þjóðarbú ekki gert hið sama og ennþá síður hið hnattræna hagkerfi. Innan slíks hagkerfis er eyðsla einnar manneskju innkoma annarrar manneskju. Hnattræna hagkerfið getur ekki eytt minna án þess að innkoman sé minni og það að innkoman sé minni þýðir fjárhagslegt hrun fyrir sumt fólk. Það þýðir að fjölskyldur missi heimili sín, að fyrirtæki verði gjaldþrota og opinber fyrirtæki segi upp starfsfólki. Það er þessi hamslausa þörf fyrir áframhaldandi hagvöxt, bæði í þessu landi og um allan heim, sem er örsök einnar stærstu ógnar sem heimurinn stendur frammi fyrir: loftslagsbreytingar.

Lausnin

Við getum bjargað heiminum án þess að valda heimskreppu með þeirri einföldu aðferð að taka burt vald einkabankanna til að búa til peninga. Umboð, í eigu almennings, ætti því að búa til peninga sem ætti að setja í umferð í þjónustu við almenning. Hugsanlega gætum við þá notið gæðanna bæði af auknum fjármunum í almenningsþjónustu og skattalækkunum. Með því að fjarlægja vald bankanna til að búa til peninga myndi þýða að útlán þeirra myndu takmarkast við þær upphæðir sem þeir geyma, alveg eins og með sameiginleg byggingafélög og samvinnubanka. Þetta myndi takmarka peningamagnið á fasteignamarkaðinum og þar með binda endi á ofþenslu. En sennilega, og það sem er mikilvægast, þá myndum við enda tilgangslausan og ofsafenginn eltingaleik dagsins í dag hjá heilu hagkerfunum við að reyna að hlaupa frá skuldinni – þegar skuldin er grunnur peningaforða þeirra. Það er þessari árangurslausa tilraun til að sleppa undan skuld sem er orsök svo mikillar eyðileggingar á loftslagi heimsins og umhverfi.

Heilabrot

Sannir eiginleikar peningaforðans er svo ólíkir almennum skilningi að það að reyna að skilja þá og allar afleiðingar þeirra er allt annað en auðvelt. Taktu þér tíma, en ekki of mikinn; því lengur sem ástandið varir því verra verður það og það verður unga kynslóðin sem neyðist til að axla byrðarnar. Sviksamlegt peningakerfi nútímans er á sínum stað vegna útbreiddrar vanþekkingar. Þú skalt fræðast um stöðuna. Það eru til bækur um efnið en auðveldasta leiðin er í gegnum netið. Vopnaður þessari þekkingu þá skaltu tala við vini þína um efnið. Spurðu þá hvaðan þeir haldi að peningarnir komi og hvernig þeir verða til. Það á eftir að koma þér á óvart hvað flest fólk veit lítið. Aðeins með því að binda enda á þessa útbreiddu vanþekkingu getum við endað stóra bankasvindlið og öll þau vandamál sem stafa af því.

Egilsstaðir, 24.12.2014 Jónas Gunnlaugsson

Bloggar | Breytt 9.11.2019 kl. 23:44 | Slóð | Facebook | Athugasemdir (2)

Athugaðu, að þetta er eins og hálfs árs gömul grein, þekkingin flýgur áfram.

Athuga að það geta verið margir aðrir með svipað, ég þurfti að leita þó nokkuð til að finna þetta.

Takið að ykkur að leita að lausnum.

Munum að Nikola Tesla leitaði að vissum lausnum og kom með Niagara virkjunina, rafalana, spennana, háspennu línurnar, og flutti orkuna til borgarana.

Stór hluti af því sem hann bauð upp á, er falið enn þann dag í dag.

Við getum haldið á lofti góðum lausnum fyrir fólkið.

Það er fullt af greinum, sem leita að vandræðum, og greinum til að afvegleiða.

Aðrir gætu verið komnir mun lengra, og að þeim þarf að leita.

Leita að greinum sem leita lausna.

Vísindamaðurinn sagði, leitið og þér munuð finna. Punktur.

Neðst í greininni stendur, að þetta gæti verið komið fyrir alla á næstu 5 árum, aðrir gætu verið komnir lengra segi ég,

“This study represents real progress in regenerative medicine and opens the door to new treatment options for people with age-related macular degeneration. We hope this will lead to an affordable ‘off-the-shelf’ therapy that could be made available to NHS patients within the next five years.”

000

Stem Cell Patch Restores Vision in Patients with Age-Related Macular Degeneration

Þessi slóð hér er frá bing.com hitt er frá mail.

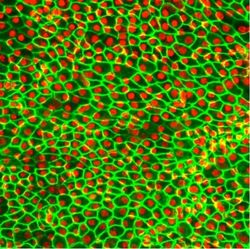

Stem cell-derived retinal pigmented epithelial cells. Cell borders are green and nuclei are red. (Photo Credit: Dennis Clegg, UCSB Center for Stem Cell Biology and Engineering)

Two UK patients suffering from vision loss caused by age-related macular degeneration (AMD) have regained their sight thanks to a stem cell-based retinal patch developed by researchers from UC Santa Barbara (UCSB). The preliminary results of this promising Phase 1 clinical study were published yesterday in the journal Nature Biotechnology.

AMD is one of the leading causes of blindness and affects over six million people around the world. The disease causes the blurring or complete loss of central vision because of damage to an area of the retina called the macula. There are different stages (early, intermediate, late) and forms of AMD (wet and dry). The most common form is dry AMD which occurs in 90% of patients and is characterized by a slow progression of the disease.

Patching Up Vision Loss

In the current study, UCSB researchers engineered a retinal patch from human embryonic stem cells. These stem cells were matured into a layer of cells at the back of the eye, called the retinal pigment epithelium (RPE), that are damaged in AMD patients. The RPE layer was placed on a synthetic patch that is implanted under the patient’s retina to replace the damaged cells and hopefully improve the patient’s vision.

The stem cell-based eyepatches are being implanted in patients with severe vision loss caused by the wet form of AMD in a Phase 1 clinical trial at the Moorfields Eye Hospital NHS Foundation Trust in London, England. The trial was initiated by the London Project to Cure Blindness, which was born from a collaboration between UCSB Professor Peter Coffey and Moorsfields retinal surgeon Lyndon da Cruz. Coffey is a CIRM grantee and credited a CIRM Research Leadership award as one of the grants that supported this current study.

The trial treated a total of 10 patients with the engineered patches and reported 12-month data for two of these patients (a woman in her 60s and a man in his 80s) in the Nature Biotech study. All patients were given local immunosuppression to prevent the rejection of the implanted retinal patches. The study reported “three serious adverse events” that required patients to be readmitted to the hospital, but all were successfully treated. 12-months after treatment, the two patients experienced a significant improvement in their vision and went from not being able to read at all to reading 60-80 words per minute using normal reading glasses.

Successfully Restoring Sight

Douglas Waters, the male patient reported on, was diagnosed with wet AMD in July 2015 and received the treatment in his right eye a few months later. He spoke about the remarkable improvement in his vision following the trial in a news release:

“In the months before the operation my sight was really poor, and I couldn’t see anything out of my right eye. I was struggling to see things clearly, even when up-close. After the surgery my eyesight improved to the point where I can now read the newspaper and help my wife out with the gardening. It’s brilliant what the team have done, and I feel so lucky to have been given my sight back.”

This treatment is “the first description of a complete engineered tissue that has been successfully used in this way.” It’s exciting not only that both patients had a dramatic improvement in their vision, but also that the engineered patches were successful at treating an advanced stage of AMD.

The team will continue to monitor the patients in this trial for the next five years to make sure that the treatment is safe and doesn’t cause tumors or other adverse effects. Peter Coffey highlighted the significance of this study and what it means for patients suffering from AMD in a UCSB news release:

Peter Coffey

“This study represents real progress in regenerative medicine and opens the door to new treatment options for people with age-related macular degeneration. We hope this will lead to an affordable ‘off-the-shelf’ therapy that could be made available to NHS patients within the next five years.”

000

Egilsstaðir, 07.11.2019 Jónas Gunnlaug

Bloggar | Breytt 8.11.2019 kl. 01:04 | Slóð | Facebook | Athugasemdir (0)

The real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoad

https://www.youtube.com/watch?v=RrFSO62p0jk

Hér er sagt að ekki má bókfæra veðið hjá bankanum, niður þótt það komi kreppa, og sama þarf að gilda um húseigandann.

In the 1930s, mark-to-market accounting actually took lots and lots of banks out. *

In fact, it was such a bad law

that the SEC at the time told Franklin Delano Roosevelt

that he should get rid of it,

and he did in 1938.

It didn't come back, all the way till 2007.

On March 9, 2009, they announced the hearing,

held the hearing on March 12, changed the accounting rule on April 2,

So, what does mark-to-market accounting do?

000

Smá endursögn á íslensku.

Bókhaldslögin, reglugerðin, reglan, sem setti hvern bankann af oðrum á hausinn 2008 var mark-to-market accounting, það er núsöluvirði eigna.

Í kreppu, vildi engin kaupa neitt, og þá varð bankinn bókhaldslega eignalaus.

Þessi regla var notuð fyrir 100 árum og í kreppunni 1930 var hún sett til hliðar.

Árið 2007 var reglan virkjuð, og þá urðu bankarnir bókhaldslega eignalausir í kreppunni 2008, og allt fór á verri veg.

Þarna urðu 300 milljarða dollara vandræði, sem eru smámunir, að 4 trilljóna dollar vandræðum.

Þingmaðurinn Barney Frank lét breyta bókhaldsreglunni 2.4.2009 og þá fór fjármálakerfið að lagast.

Vandræði bankana voru vegna þessarar bókhaldsreglu, um að nú söluverðmæti eigna væri bókfærð sem eign, og urðu bankarnir þá eignalausir þegar kreppan kom og allt varð óseljanlegt.

000

Textauppskrift

00:00

Translator: Queenie Lee Reviewer: Peter van de Ven

00:07

I'm about to tell you some unconventional wisdom, alright?

00:14

I called my talk today "The real truth about the 2008 financial crisis."

00:21

So, I guess what I ask you to do this morning

00:23

is to think about what you believe

00:27

what the conventional wisdom is about 2008,

00:31

and I'm going to put some words in your mind or describe it this way,

00:35

and that is most people believe

00:37

that the free-market capitalist system, especially bankers, are greedy,

00:45

they go through periods of excess speculation,

00:51

and then the world collapses

00:54

and the government has to come in and save us.

00:58

By the way, this is the story that was told about the Great Depression,

01:02

and it is also the story that is told about the 2008 financial crisis.

01:09

Now, before I get into the meat of my presentation,

01:12

I want you to think about something else,

01:16

and that is that the Federal Reserve

01:19

controls the level of short-term interest rates in our economy.

01:24

Everybody knows that today,

01:26

they're holding those interest rates at 0%,

01:29

trying to get the economy moving again.

01:35

What lots of people don't remember is that back in 2001, 2002 and 2003

01:42

the Federal Reserve dropped interest rates to 1%.

01:45

I want you to think about this.

01:47

Because when you make a decision to take out a loan,

01:50

when you make a decision to buy a house,

01:52

what is the most important ingredient of that decision?

01:56

I mean, obviously, whether you have income,

01:59

whether you like the house,

02:00

but one of the most important ingredients of that

02:03

is the level of interest rates.

02:05

Alan Greenspan pushed interest rates

02:08

down to 1% in 2003 and 2004.

02:14

In fact, interest rates were below inflation

02:18

for almost three years - below the rate of inflation.

02:23

Now, how do you think about this?

02:25

So, when you're looking at a house - can I afford this house, the payment?

02:29

Obviously,

02:30

those payment streams are determined by the level of interest rates,

02:33

and when interest rates are low,

02:35

you're going to buy a bigger house,

02:37

you're going to buy in a better neighborhood,

02:39

buy cherry cabinets and granite counter tops

02:41

because you can afford it.

02:43

So, let me put this into a story that I know you can understand.

02:48

And that is, when you come to a green light in your car -

02:54

you're driving along, there's a green light -

02:56

how many people in here actually have ever stopped at a green light?

03:03

I'm not talking about senior moments.

03:05

(Laughter)

03:06

I'm talking about stopping at a green light,

03:09

getting out of your car and walking around to the other side,

03:13

just to make sure the other one really is red

03:17

Because, obviously, if it was green too,

03:20

it'd be dangerous to go through that intersection.

03:23

So what happens when Alan Greenspan or the Federal Reserve

03:27

holds interest rates all the way down at 1%?

03:30

You get a green light.

03:33

You get a green light to make a purchase

03:35

that's bigger than probably you should,

03:38

and by the way, the financial system is no different than you.

03:42

Bankers, they're no different than individuals.

03:46

They would say, "Hey, with interest rates so low,

03:48

leverage, borrowing doesn't matter as much, it's cheap.

03:52

So, why don't we lever up a little bit more?

03:55

After all, it's Alan Greenspan, the smartest man in the world,

04:00

that tells us interest rates are 1%;

04:02

in other words, all the lights are green."

04:06

And, so what happens when you hold interest rates down like this?

04:10

You cause people to make decisions that they wouldn't otherwise make.

04:14

Now, let me put this in a different perspective.

04:17

House prices went up 8% in 2001.

04:23

By 2004, 2005

04:26

they went up 14% in 2004, 15% in 2005.

04:31

So you could borrow at 1%, especially with those teaser loans,

04:36

and you could have a house that was appreciating at 14%:

04:40

what a great deal!

04:42

And, so what happened is we encouraged more people to buy homes,

04:46

bigger homes than they should have at the time.

04:50

We also encouraged bankers to take on more leverage,

04:54

and make more risky bets than they would have

04:57

if interest rates were higher.

04:59

In fact, if interest rates would have been 4 or 5%,

05:02

I don't believe we would have had the housing bubble at all.

05:06

Now, let's go back in time just a little bit,

05:09

because this has happened before.

05:11

The last time the Federal Reserve really held interest rates too low for too long

05:17

was back in the 1970s.

05:20

In the 1970s, farmers bought too much land,

05:23

we drilled too many oil wells,

05:26

we were betting on oil prices going up forever,

05:29

and in the 1980s, when farmland prices collapsed and oil collapsed,

05:33

banks collapsed too.

05:35

By the way, the entire savings and loan industry

05:38

also collapsed in the 1980s

05:40

because of the same reason:

05:41

they made too many loans when interest rates were low,

05:45

and then, when interest rates went up, they collapsed.

05:48

At the same time,

05:49

we made big banks make huge loans to the Latin and South America.

05:54

And so, if you go back and look at the 1970s, banks expanded,

05:58

they made loans to farming, housing, oil, Latin and South America,

06:03

and all of those parts of the economy collapsed

06:06

in the late of 70s, early 80s,

06:08

and the banking system was in monster trouble.

06:12

In fact, the eight biggest banks in America in 1983 had no capital -

06:19

zero capital -

06:20

because they had lent too much to Latin and South American countries

06:24

that all collapsed.

06:26

And here's my point of going back to that.

06:29

That is if you go back and look at the 1980s,

06:32

the problems of the 1980s - the banking problems -

06:36

did not take down the entire economy.

06:39

This time, they did.

06:42

And so, the question is why,

06:44

and we're going to deal with that in just a minute.

06:47

And so one of the things that I want to do

06:49

is tell you something I just did, right?

06:53

This is the picture of the S&P; 500 -

06:56

the 500 largest companies in the US stock market.

07:00

It's a picture from 2008 all the way through the first half of 2009.

07:06

What I just recently did is I went back,

07:09

and I read the verbatim transcripts

07:13

of all the Federal Reserve meetings during 2008.

07:19

Now, the reason I just did this

07:21

is because they only come out with a five-year lag.

07:23

The Fed they released little statements,

07:25

and then minutes,

07:27

and then five years later,

07:28

they give us the full transcripts of what they've talked about, right?

07:32

All of those red dots, there's 14 of them, are a Fed meeting.

07:38

Normally, the Fed has six or seven meetings,

07:40

but that was a crisis year, right?

07:42

And so the Fed had 14 meetings that year.

07:46

Just to put this in perspective,

07:48

it's 18 or 20 people sitting around a table,

07:51

and the verbatim transcripts are each of them talking

07:54

for three or four minutes

07:55

if they go around and they vote and they go around again; they vote.

08:00

These transcripts were 1,865 pages long,

08:05

559,000 words.

08:09

Now, I read these for you, just so you know.

08:12

(Laughter)

08:13

And some people have a hard time, like, what is 559,000 words?

08:18

Well, the Old Testament is 593,000 words.

08:23

I mean think about that,

08:24

we've built the universe,

08:25

wandered around the desert for 40 years, 50 years,

08:28

built an ark ...

08:30

There is a lot of stuff that happened in the Old Testament.

08:33

(Laughter)

08:34

The Fed used that many words

08:37

for one year of US economic history.

08:42

Now, I could head down this road -

08:44

maybe that's another TED talk - because that's one of our problems.

08:48

Nonetheless, one of the things I want to point to

08:51

is this huge decline in the market

08:54

that happened in September and October of 2008.

08:58

You know what happened in September and October of 2008?

09:02

Well, first of all, the bloody weekend, September 13th, 14th, I think it was,

09:07

when Lehman Brothers failed, AIG, Fannie Mae, and Freddie Mac,

09:12

and all of those things happened,

09:14

and the Federal Reserve started a program called quantitative easing;

09:18

that's where they started to buy bonds and inject cash into the economy

09:22

in an attempt to save us.

09:25

At the same time, in fact, just a few weeks later,

09:29

on October 8th of 2008, Hank Paulson, the Treasury secretary,

09:36

President Bush, the Bush White House, Congress passed TARP:

09:42

the Troubled Asset Relief Plan,

09:44

and it was 700 billion dollars of government spending

09:48

to save our banking system, okay?

09:51

I want you to take a look at this chart a little more closely.

09:55

Quantitative easing started right here, TARP was passed right there.

10:01

Did it help?

10:04

In fact, the worst part of the crisis was after TARP was passed.

10:09

The stock market fell 40%;

10:12

financial-company stocks fell 80% after TARP was passed.

10:18

In fact, if I look at this chart and kind of squint at it,

10:21

look at all those red dots,

10:22

I would say the more the Fed met, the more the Fed did, the worse it got.

10:28

So, something else must have been going on, right?

10:33

In my opinion,

10:35

the government did not save us,

10:37

and in fact, this is one of the problems that people have

10:40

when they're trying to understand the economy.

10:43

You see, there's an interesting fact about our world, and that is

10:47

the free market - capitalism -

10:52

does not have a press agent;

10:56

the government does.

10:59

The Federal Reserve does.

11:02

In fact, there are about 2,000 books about the financial crisis,

11:05

but there are three main ones that have just come out.

11:08

One is by Timothy Geithner,

11:09

former Secretary of the Treasury under President Obama.

11:13

He was the head of the New York Federal Reserve Bank during 2008.

11:20

He'd written a book about the crisis;

11:22

who do you think he says

11:24

saved the world?

11:25

(Laughter)

11:27

Timothy Geithner, of course.

11:29

Ben Bernanke.

11:31

He doesn't have a book out - he has a book of speeches out -

11:33

who do you think he says

11:35

saved the world?

11:37

Ben Bernanke.

11:39

Hank Paulson has a book out,

11:41

and who do you think he says saved the world?

11:43

Hank Paulson.

11:44

In fact, it's not really that they take credit themselves,

11:47

but they credit TARP

11:49

and quantitative easing and stress tests;

11:52

that's what Timothy Geithner takes credit for:

11:55

stress testing banks, so that everybody can trust them, right?

11:59

This is where I want to shift gears, just a little bit,

12:03

because what I want to tell you is why - or explain -

12:08

is why I believe this banking crisis

12:12

turned into a true overall economic crisis,

12:16

while if you look back in the early 1980s,

12:19

where banks had more losses than they did in 2008,

12:23

the economy did not collapse,

12:25

and in fact started to accelerate without TARP,

12:28

without quantitative easing.

12:30

In fact, Paul Volcker was raising interest rates in the early 1980s,

12:34

and the economy recovered.

12:36

Here we cut interest rates to zero,

12:38

and the economy has grown relatively slowly.

12:41

So, what caused this problem?

12:44

By the way, in those transcripts that I said that I read,

12:47

Ben Bernanke asks his staff to go out and find out how big the problem is,

12:53

how many subprime loans were made,

12:56

how many losses could we face,

12:58

and he has a staff of about 200 Ph.D. economists,

13:03

and they came back with a number of 228 billion dollars.

13:07

Now, don't get me wrong,

13:10

I'd love 228 billion dollars, right?

13:13

But 228 billion dollars is small compared to a 15 trillion dollar economy.

13:19

So, how did that small problem turn into a problem

13:24

that almost took down a 15 trillion dollar economy,

13:27

and the answer is mark-to-market accounting.

13:31

It's a little-known accounting rule

13:33

that most people know nothing about, right?

13:37

It was put into place in November 2007

13:40

after being out of place, not enforced, since 1938.

13:45

Now, let me give you a little bit of background on an accounting.

13:50

In the 1800s, bookkeepers,

13:54

they were bookkeepers.

13:56

They weren't the accounting profession yet.

13:59

They were getting more and more sophisticated,

14:01

but they usually marked everything to market.

14:04

So, if you think about this,

14:05

if the farmland goes up in value, if your machinery goes up in value,

14:09

if your inventory, if loans go up in value,

14:11

you get to mark those up.

14:13

So, in good times, things look better,

14:15

but then, when you start marking things down, things look worse.

14:19

And I believe that if you go back to the 1800s,

14:21

this is one of the reasons why we have very sharp dips and drops in the economy,

14:26

panics and depressions

14:28

and things like that.

14:30

In the 1930s, mark-to-market accounting actually took lots and lots of banks out.

14:36

In fact, it was such a bad law

14:38

that the SEC at the time told Franklin Delano Roosevelt

14:41

that he should get rid of it,

14:43

and he did in 1938.

14:45

It didn't come back, all the way till 2007.

14:48

So, what does mark-to-market accounting do?

14:51

Well, let me give you a story.

14:53

Just imagine you live on the coast of Texas, in Galveston, Texas,

14:59

and you have a $500,000 house right in Galveston, near the beach,

15:05

and you have a $300,000 mortgage,

15:07

and there is a hurricane on the way.

15:10

And it's only four or five hours away,

15:12

and they've told you to evacuate your neighborhood,

15:16

and you're packing up your pictures,

15:18

you're packing up your most important belongings,

15:20

and just before you leave the driveway, your banker shows up.

15:25

(Laughter)

15:26

And your banker says,

15:27

"You have a $300,000 mortgage on this house,

15:31

and there's a hurricane coming.

15:33

Your house is about to be destroyed.

15:35

We're really, really worried about our loan.

15:37

I know you've paid every payment,

15:39

but we're going to have to mark this house to market."

15:43

And you're like, "Well, everybody's gone, no one left.

15:45

I saw the realtor leave. Who's going to bid on this house?"

15:49

He said, "Don't worry, there's a fire truck.

15:51

Let's get the fireman to bid on it.

15:54

They stopped the fire truck, said, "Hey, make a bid on this house."

15:57

Fireman says, "There's a hurricane about to hit.

16:00

I'll pay 20 grand for it,"

16:02

and the banker says, "You know what, you owe me $300,000,

16:05

but the house is only worth $20,000

16:07

because that's the bid.

16:09

So, if you can't come up with $280,000 dollars right now,

16:15

you're going to lose your house.

16:17

You're bankrupt.

16:18

That's what mark-to-market accounting is.

16:21

And so in 2008, what we did is we said -

16:24

what people were doing is -

16:25

they were saying a hurricane is heading, that no ones are worth nothing,

16:29

and so, banks couldn't sell assets, they wouldn't buy assets,

16:34

and in reality, what happened is their losses spiraled out of control,

16:38

and it turned to a $300 billion problem into a $4 trillion problem.

16:45

Now, the amazing thing is, right at the bottom,

16:49

March 9, 2009,

16:52

something changed the world.

16:54

There's a little-known - well, actually he's not little-known,

16:57

but he's retired now - Congressman named Barney Frank.

17:01

His financial services committee actually held a year,

17:04

and he brought the accountants in

17:05

and said, "We don't think this rule is right,"

17:08

and they changed the accounting rule.

17:10

On March 9, 2009,

17:12

they announced the hearing, held the hearing on March 12,

17:15

changed the accounting rule on April 2,

17:17

and from that point on, the economy has grown;

17:20

the stock market is up 200%.

17:23

And, what I'm getting to here is the fact

17:26

that I believe this crisis was not generated by over-speculation,

17:33

well, in fact, was caused by the Federal Reserve in the first place,

17:37

and by changing this accounting rule,

17:39

we brought about a recovery in our economy that most people don't understand.

17:45

What they do believe

17:46

is that the government has caused the recovery,

17:50

especially the Federal Reserve through quantitative easing.

17:53

I want you to think about this for one second, and then I'll close.

17:57

That is that what the Federal Reserve does is they go out and buy bonds,

18:02

and when they buy bonds, they inject cash into the banking system,

18:05

and typically, banks will take that money and lend it out,

18:09

but in the last five years, banks haven't.

18:12

What banks have done is they've begun to sit on excess reserves.

18:15

And so, when you look at the economy today and see how it's growing,

18:20

what's fascinating about this

18:23

is that this growth is actually coming from entrepreneurship.

18:28

I want you to remember one thing,

18:30

and that is Ben Bernanke and Janet Yellen have never stayed up all night

18:36

drinking Red Bull, eating pizza and writing Apps;

18:41

(Laughter)

18:42

they've never fracked a well;

18:44

they haven't ever built a 3D printer.

18:47

And so, when you look at our economy, what I'd like you to do is have faith

18:52

that the free market actually works,

18:54

and realize that many many times,

18:56

government, rules, regulations and actions,

18:59

especially with interest rates, have major impacts.

19:03

I think the understanding of 2008 that people have, the conventional wisdom,

19:08

that banks lost control is actually the wrong thing.

19:12

I believe it's government that lost control,

19:15

and by fixing that rule,

19:17

we actually started the recovery that's underway.

19:20

Thank you very much.

19:21

(Appla

Egilsstaðir, 03.11.2019 Jónas Gunnlaugsson

Þarna urðu 228 milljarða dollara vandræði að 4 trilljarða dollara vandræðum, þegar hugsanlegt núsöluverð eigna var bókfært sem verðmæti eigna bankana. Þá fóru margir bankar á hausinn, og Bandaríkin björguðu mörgum, en ekki þeim íslensku.

Bloggar | Breytt 31.3.2020 kl. 23:59 | Slóð | Facebook | Athugasemdir (0)